ohio hotel tax calculator

2021 Ohio IT 1040 Individual Income Tax Return - Includes Ohio IT 1040 Schedule of Adjustments IT BUS Schedule of Credits Schedule of Dependents IT WH and IT 40P. Thrall textbook of veterinary diagnostic radiology pdf.

How To Calculate Wages 14 Steps With Pictures Wikihow

65 100 0065.

. Overview of Ohio Taxes. Now multiply that decimal by the pretax cost of the room to find out how much the hotel tax will add to your bill. What is the sales tax rate in Franklin County.

List price is 90 and tax percentage is 65. 1 State lodging tax rate raised to 50 in mountain lakes area. In transactions where sales.

Counties and cities can. 7 state sales tax plus 6 state hotel tax 13 if renting a hotel or room. NA tax not levied on accommodations.

Lodging taxes are in lieu of a sales. Avalara automates lodging sales and use tax compliance for your hospitality business. The Ohio state sales tax rate is 575 and the average OH sales tax after local surtaxes is 71.

The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio. The Ohio OH state sales tax rate is currently 575. Sports and a 1 percent municipal hotel tax.

The tax rate was increased to 4 effective. Depending on local municipalities the total tax rate can be as high as 8. Please see Information Release IT 2018-01 entitled Residency Guidelines - Tax Imposed on Resident and Nonresident Individuals for Taxable Years 2018 And Forward as well as the.

Avalara automates lodging sales and use tax compliance for your hospitality business. So if the room costs 169. Ad Finding hotel tax by state then manually filing is time consuming.

The minimum combined 2022 sales tax rate for Franklin County Ohio is. Other local-level tax rates in the state of Ohio are quite complex. Forms The collection of Lucas County HotelMotel lodging tax as permitted by Chapter 5739 of the Ohio Revised Code is coordinated by the Office of Management and BudgetThe local rule.

Groceries and prescription drugs are exempt from the Ohio sales tax. Ohio Property Tax Rates. Sections of Ohio Revised Code.

Effective January 1 1969 the City of Columbus implemented a 3 tax on the room rental income of hotelsmotels located in Columbus Ohio. Multiply price by decimal. Usually the vendor collects the sales tax from the consumer as the consumer makes a.

HotelMotel Lodging Tax County Administration Building Room 603 138 East Court Street Cincinnati Ohio 45202. No additional local tax on accommodations. Away in a manger handbells.

Ad Finding hotel tax by state then manually filing is time consuming. Only In Your State. The Springfield City Code Chapter 70 Article V requires hotels motels and tourist courts to pay a tax equal to 5 of the gross rental receipts paid by transient guests for sleeping.

Ohio Property Tax Calculator. Sections 307672 307695 351021 50556 50557 573908 and 573909. Divide tax percentage by 100.

7 state sales tax plus 1 state hotel tax 8 if renting a whole house. Other agencies churches social groups Ohio schools Ohio. Property tax rates in Ohio are higher than the national average which is currently 107.

This is the total of state and county sales tax rates. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. The price of the coffee maker is 70 and your state sales tax is 65.

How To Calculate Wages 14 Steps With Pictures Wikihow

Prorated Rent Calculator How To Prorate Rent

Calculating Payroll For Employees Everything Employers Need To Know

Sale Vintage The Red W Booklet Advertising Pocket Calculator Etsy Pocket Calculators Booklet Vintage Advertisements

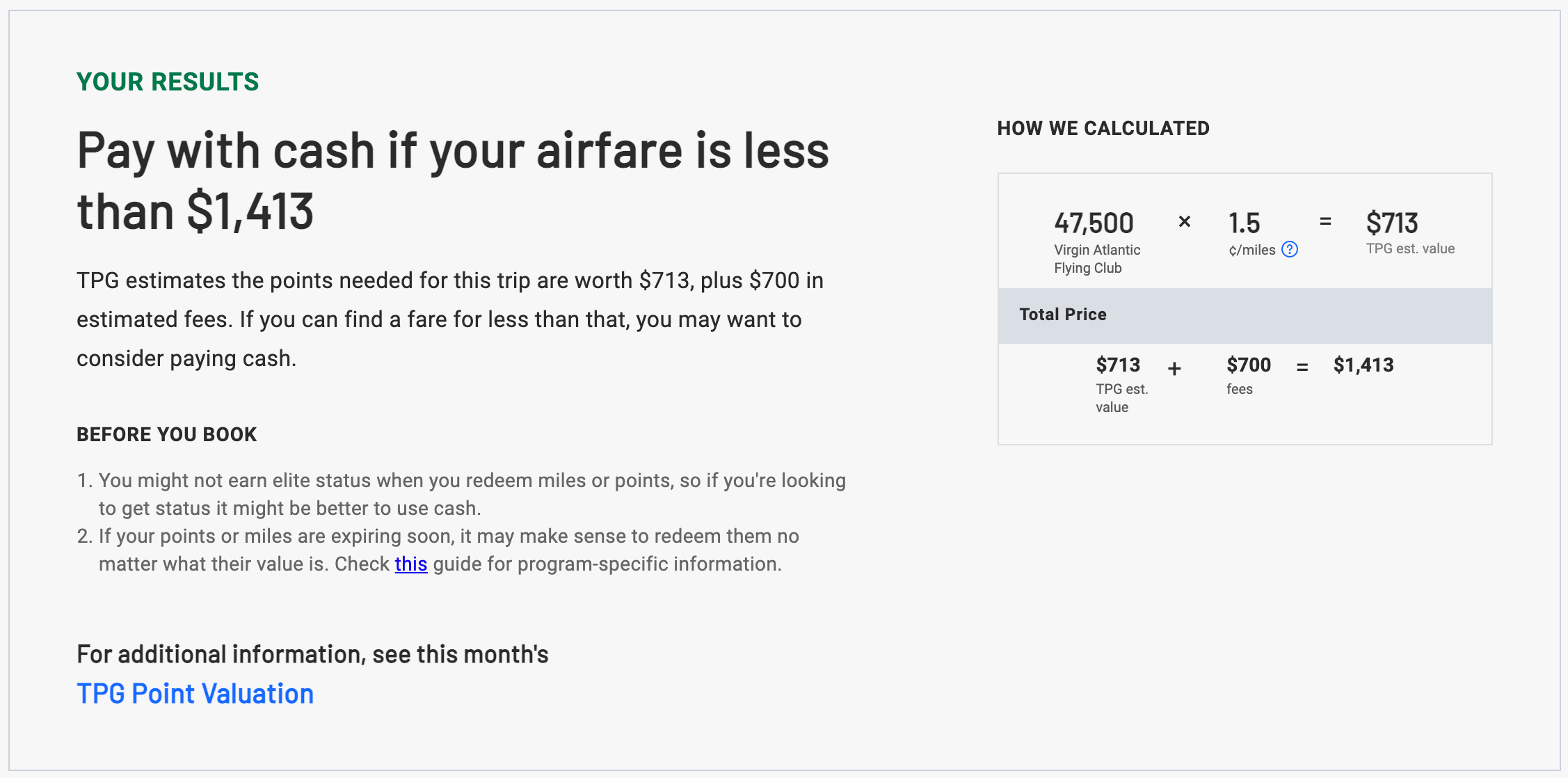

Tpg Releases Brand New Points Calculator To Make Award Bookings Easier

Monroe 8145x 14 Digit Heavy Duty Printing Calculator Monroe Systems

How To Calculate Your Electric Bill Direct Energy

Taxes On Stocks How Do They Work Forbes Advisor

How To Calculate Credit Card Payment

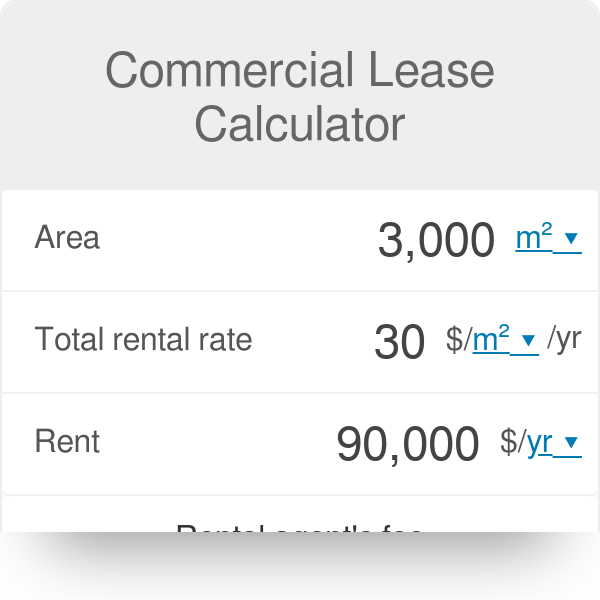

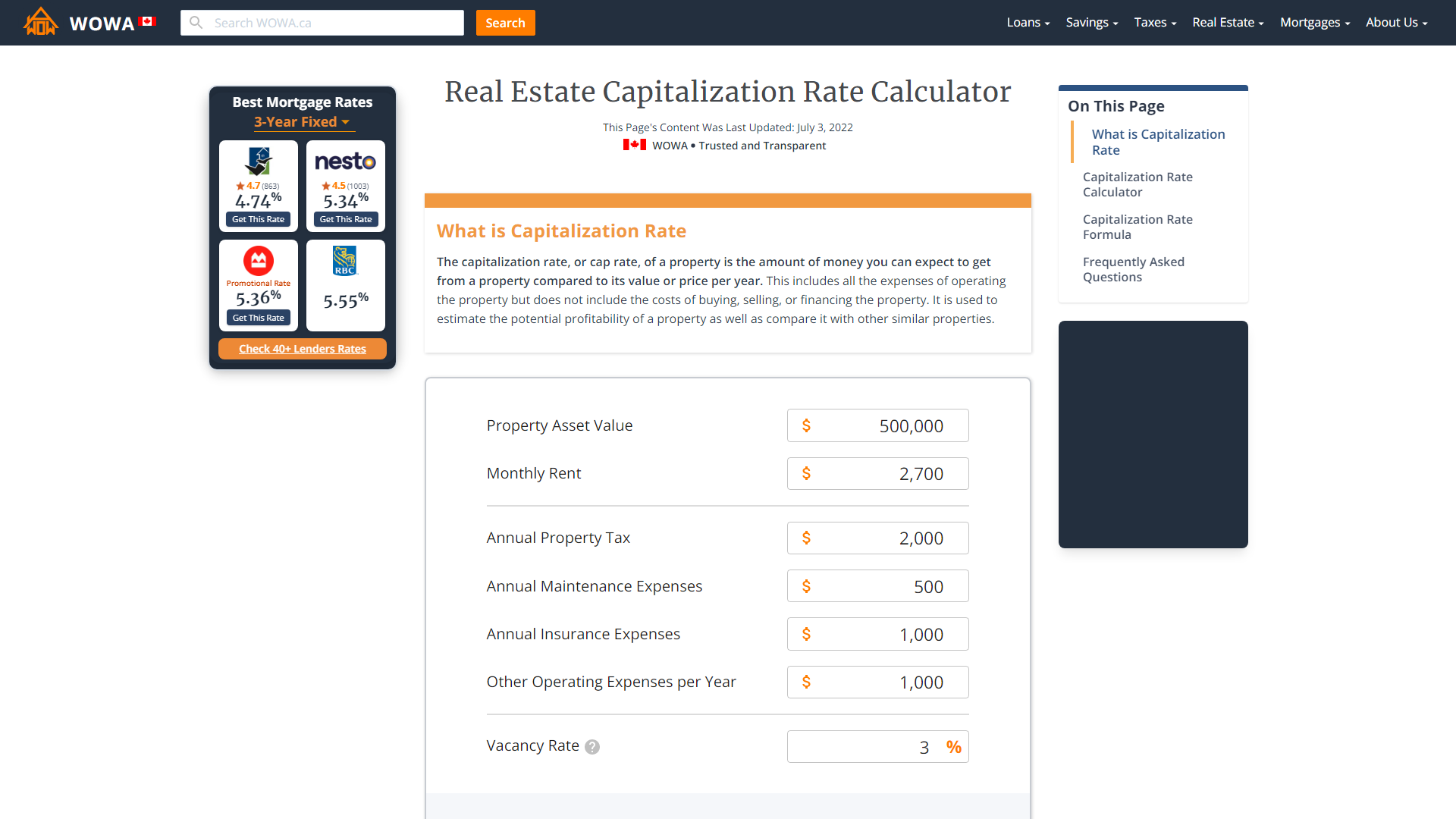

Cap Rate Calculator Formula And Faq 2022 Wowa Ca

How To Calculate Wages 14 Steps With Pictures Wikihow

How To Estimate Your 2021 Tax Refund Tips Calculators And More Cnet